Will interest rates drop? Tembo's base rate predictions

Anya Gair, Head of Organic

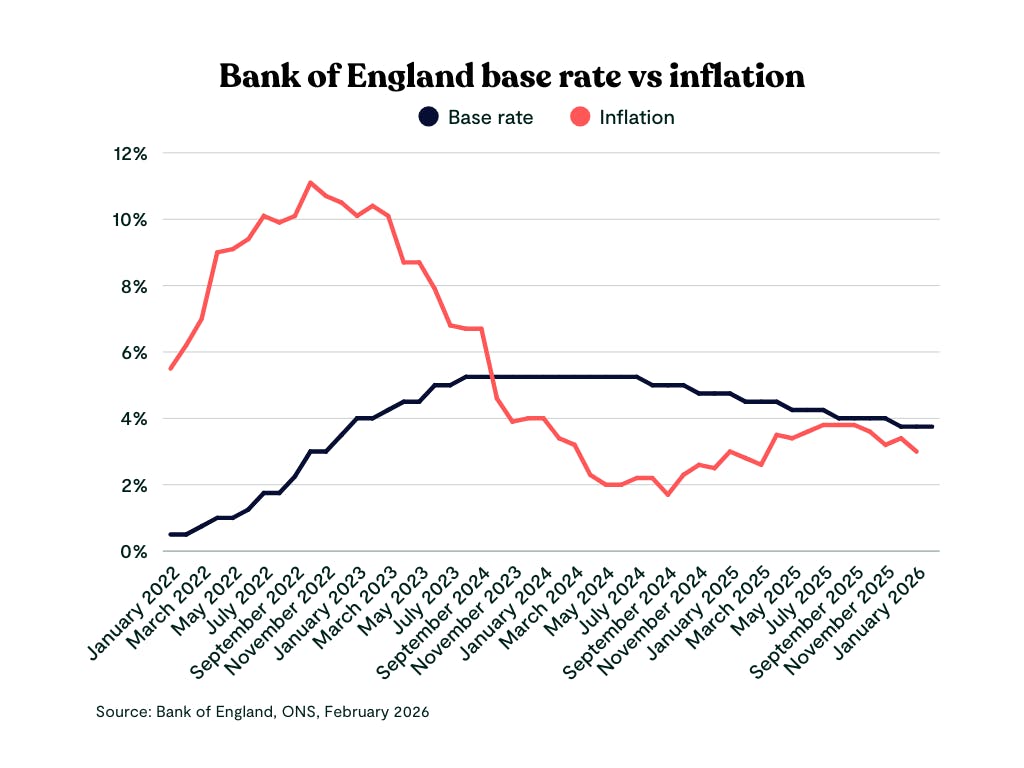

Anya Gair, Head of OrganicAfter a tough period of rising costs and uncertainty, change is finally coming. The Bank of England is predicted to cut its base rate further by the middle of 2026. This move will be driven by easing inflation and could significantly impact mortgage rates, savings accounts, and the housing market.

Here’s what you need to know and how it could affect you.

Key takeaways

- After cutting to 3.75% in December 2025, the Bank of England is expected to further cut the base rate to 3.5% at the next MPC meeting in March.

- Inflation is easing despite a slight rise in December to 3.4%, and could fall to 2.5% by late 2026.

- Mortgage rates are dropping, with some fixed rates the lowest since 2022. Homeowners, home movers and first-time buyers could see better rates and lower monthly payments.

- Mortgage rates should continue to fall in 2026, but likely not until the middle of the year. While house prices are likely to stay sluggish, impacting available housing stock.

- After the December base rate cut, savings rates have started falling, so savers might want to review their options soon and make the most of competitive rates available right now

See how rate changes affect your options

Compare live mortgage rates from over 100 lenders and 20,000 mortgages instantly with our comparison table.

What will happen to the base rate in 2026?

It's expected that the Bank of England will cut its base rate further in 2026, but only one rate cut is currently expected, possibly coming in as early as March when the MPC meets on the 19th. This could bring the base rate down to 3.5% with a 0.25% cut. Some are even more hopeful, predicting the base rate to reach 3% by the end of the year.

Why is the Bank of England expected to cut rates?

The main reason the base rate is expected to go down in 2026 is due to falling inflation. The latest inflation figures show that the current inflation rate stands at 3.0%, falling sharply from 3.4% the month before. This is the lowest rate in 10 months, and is predicted to keep dropping, possibly hitting 2.5% by late 2026.

While the latest inflation news rules out the likelihood of a base rate cut in February, with inflation expected to keep edging closer to the government's 2% target, the need for holding the base rate steady is fading fast.

How will a base rate drop affect mortgages?

This is good news if you own a home or want to buy one in 2026. But remember that lenders usually cut rates before a base rate cut is announced. This is why we saw mortgage rates drop before the base rate cut on the 18th December 2025. With a base rate cut expected in March 2026, it's likely we'll see mortgage rates continue to drop ahead of this.

"I've seen a lot of my customers hold off, waiting for mortgage rates to fall. Some lenders have already dropped their rates, and while we might see some more ahead of a potential base rate cut in March, this isn't guaranteed. So if you're on the fence, don't wait to find out your options!"

Brad Wright

Senior Mortgage Advisor at Tembo

Here's what a base rate cut in March 2026 could mean for mortgage rates:

- Fixed-rate mortgages: Lenders are already racing to offer better deals, with some top lenders offering fixed rates from just 3.55%, as low as deals offered in 2022. This mortgage price war means borrowers have more options and lower monthly costs.

- Variable-rate mortgages: If you have a variable-rate mortgage, further base rate cuts could lower your payments more.

- Coming to the end of a fixed-rate deal? You now may have better options when you remortgage vs a couple of months ago. Grabbing a new, lower rate can mean real savings over time.

You might also like: How long should I fix my mortgage for?

Want to stay ahead of the latest changes?

See what mortgage rates you could be offered, without applying. Complete your details online today.

What's the outlook for the housing market?

After a slow second half of 2025, lower inflation and falling mortgage rates could spark life back into the property market in 2026. But with changes to taxes after the budget and real wages not keeping up with inflation, affordability will still be stretched for many. Plus, with sluggish house price growth, we could see aspiring home movers hold off selling, impacting the supply of new homes to the market for first-time buyers.

Despite this, homeowners with upcoming remortgages will still be hunting for the best deals as their fixed-rate deals come to an end to avoid going onto the lender's costly SVR. Some will also remortgage to move to a further advance mortgage, or to consolidate debt. While specialist mortgages like guarantor schemes will also continue to help aspiring home buyers plug the gap between what they need and what they can afford alone.

"Mortgage rates should continue to fall in 2026, but it's likely we won't see any significant movement until the middle of the year. So don’t hold out for rates to tumble to lock in a deal. Getting expert advice on your options now is crucial!"

Brad Wright

Senior Mortgage Advisor at Tembo

Keep reading: Tembo's mortgage rate predictions for 2026

What about saving rates?

A base rate cut is great for borrowers, but less so for savers. Higher rates have given savers better returns in recent years, making savings accounts much more attractive.

As the base rate drops, savings account rates have followed. If you’ve enjoyed bigger returns lately, it might make sense to look at transferring to a provider offering the best rates, or lock in a fixed-rate deal soon.

What should you do next?

Further base rate cuts are a big deal for the UK economy. Homeowners on variable rates or upcoming remortgages could see real relief, lower payments and better deals. While first-time buyers have a new window of opportunity, as lower rates mean it’s easier to afford your first home, even with a small deposit.

For savers, this marks a turning point. Savings rates may start to dip, so act soon if you want to secure a good rate by transferring to another provider, or consider opening a new account with a competitive interest rate.

Change can be confusing, but you don’t have to figure it out on your own. If you want help buying your first home, remortgaging, or making sense of what’s happening in the market, we’re here for you.

Discover your mortgage options with the UK's Best Mortgage Broker

As an award-winning mortgage broker, we specialise in helping buyers, movers, and remortgagers maximise their affordability. Our expert team is available seven days a week, ready to help you make the right decisions with confidence.