What is inflation and how does it affect you?

Anya Gair, Head of Organic

Anya Gair, Head of OrganicEveryone seems to be talking about inflation right now, whether you’re scrolling through TikTok or chatting to the barman in your local pub. It can be hard to avoid it. It’s most visible in our bank accounts and wallets, the cost of filling up our cars or heating our homes, or the weekly trip to the big Tesco.

But what does the inflation rate actually mean, and how does inflation affect mortgage rates? Let’s explore how it works and what you can do to reduce the cost of your mortgage.

What is inflation and how does it impact mortgage interest rates?

What is the inflation rate?

The inflation rate is the measure of how much the price of products or services has increased over time. For example, if a loaf of bread cost £1 today and £1.05 this time next year, annual bread inflation would be 5%. The changes in price from one month to the next is used to calculate the UK’s inflation rate.

To work out the inflation rate, the Office for National Statistics (ONS) tracks the prices of everyday items by creating an imaginary ‘basket of goods’ - 744 items to be exact. This is known as the Consumer Prices Index (CPI), but you might also see it as Consumer Prices Index including housing costs (CPIH).

The basket is regularly updated to ensure it’s an accurate reflection of consumer behaviour. In 2024, air-fryers, vinyl music, gluten-free bread and edible sunflower seeds were added to the basket, while hand hygiene gel and rotisserie-cooked chicken were removed.

What is the current inflation rate in the UK?

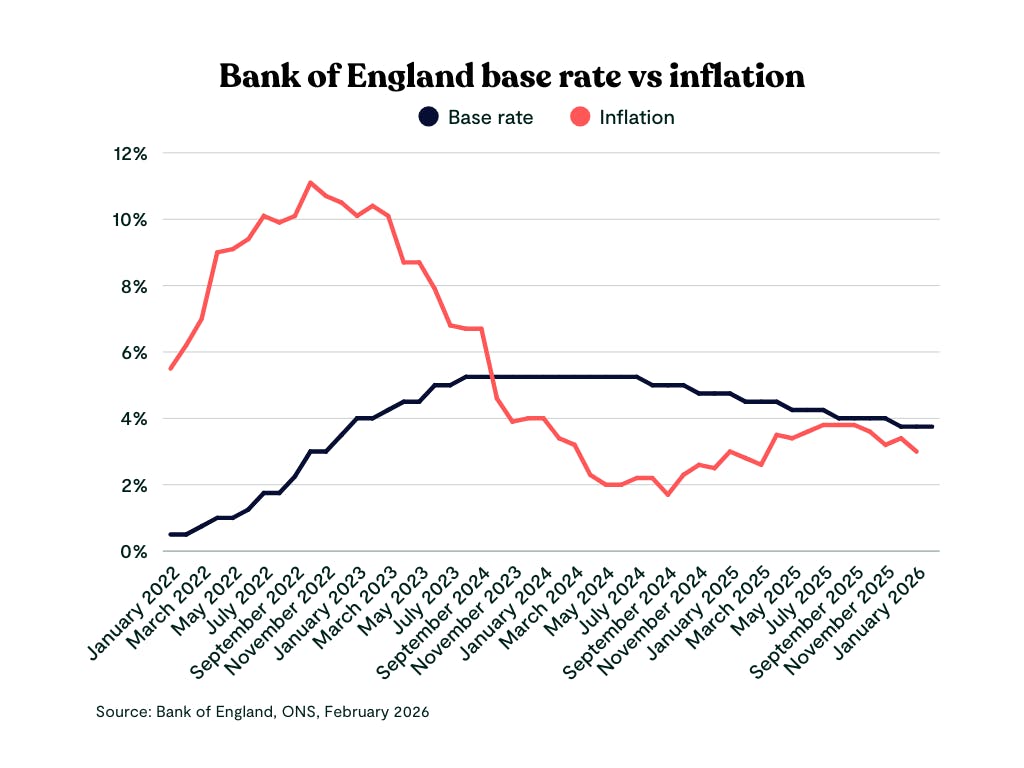

The latest inflation figures show that the current inflation rate (CPI) in the UK is 3.0%, falling sharply from 3.4% the month before. This is the lowest rate in 10 months, mainly due to falling petrol prices and airfares, but the cost of cupboard staples, such as bread and cereals also fell.

This drop gives the Bank of England the wiggle room it needs to consider cutting interest rates, which is why the market currently is predicting the Bank will cut its base rate in March. As lenders price in base rate cuts before they happen, when a base rate cut looks more likely, we could begin to see lenders could start reducing their own rates over the next few weeks, but as ever, this isn't guaranteed. See what rate you could get now without applying.

"We could see lenders start to drop their rates in anticipation of an expected drop in the base rate in March. So if you're on the fence, don't wait to find out your options!"

Brad Wright

Senior Mortgage Advisor at Tembo

See what mortgage rates you could be offered

Complete your details online to see your best mortgage options from across our panel of over 100 lenders, including ways you could boost your buying power. Discover yours today!

How does inflation impact me?

Inflation impacts the general cost of living, as it affects the buying power of your money. When inflation rises, the price of everyday items and services increases. Interest rates also tend to increase, impacting the rates we can get on loans like mortgages and savings accounts. Rising inflation also means that wages have to work harder to keep pace with these increases, otherwise your earnings won't go as far as before!

When a person’s wages fail to keep up with inflation, they’ve effectively been given a pay cut, as their salary won't go as far if the cost of food, clothes, energy, petrol, and other living expenses has risen at a much faster rate.

Although the most recent figures have shown the annual average wage growth rate at 4.5%, when adjusted for inflation, the annual growth in real terms is a mere 0.6%.

You might like: How to ask for a pay rise

How does inflation affect mortgage rates?

When inflation drops, this gives the Bank of England more wiggle room to reduce the base rate. This is the rate the Bank of England charges other banks and lenders to borrow money, and is a lever the Bank can pull to curb inflation when it rises too high. The base rate was increased multiple times over 2023, but over 2024 it was cut twice, with the base rate now standing at 3.75% and predicted to be cut in March 2026.

When the base rate goes down, this tends to influence mortgage lenders to drop their own interest rates. This can be good for borrowers, as it can lead to lower borrowing costs, making their debts more affordable, including mortgage repayments.

You might also like: Is now a good time to save money?

Does inflation affect fixed rate mortgages?

If you have a fixed rate mortgage, you won’t see a change in your monthly payments when the inflation rate rises until the end of your fixed term. When your fixed term expires, you’ll usually be moved onto your lender’s standard variable rate, which rises and falls based on changes in the market, or you can remortgage onto a new fixed rate deal.

In the months before your fixed rate expires, it’s a good idea to start looking for a new mortgage deal. Luckily, this is something we can help you with. Our smart tech will compare thousands of mortgage deals across the market in an instant to find which ones you’re eligible for. Complete your details online to get started.

Discover how much you could boost your buying budget

We've helped thousands of buyers discover how they could boost what they could afford. On average, our customers increase their buying budget by £82,000. To find out which buying schemes you could be eligible for and how much you could afford, complete your details online.

Should I fix my mortgage?

If you’re on a variable rate mortgage or your current fixed rate mortgage deal is coming to an end, we recommend looking at both fixed rate and variable deals to compare what’s available. During periods of market volatility, a fixed deal can protect you from fluctuations.

For example, in the 1990s and early 2000s when interest rates fluctuated between 3.5% and 14.88%, those lucky enough to fix at the lower end of the scale were offered a lot of protection.

Equally, a variable rate mortgage can offer an opportunity to access lower interest rates and therefore lower monthly repayments. To understand whether a variable rate might suit you, calculate what your monthly repayments would be with the current market rates on variable mortgages. Add 1%, 2% and 3% to the interest rate and check the repayments. Does that seem comfortable for you? If not, the risk might not be worth the potential reward for you.

It’s always best to seek expert advice when it comes to deciding whether to fix your mortgage or not. If you feel overwhelmed looking at the different rates available, get in touch with our expert team.

Read more: How long should I fix my mortgage for?

How does inflation affect savings rates?

Inflation impacts interest rates for savings by influencing what rates savings providers can offer their customers. The Bank of England charges other banks and lenders to borrow money through the base rate. When the base rate goes up or stays high, this makes it more expensive for providers to loan money to their customers, so they typically will also raise their interest rates in response.

Inflation also impacts the purchasing power of your money. High inflation erodes the purchasing power of your money over time unless the interest you earn on your savings outpaces inflation. Banks may respond to high inflation by increasing savings rates to attract deposits, but the rates offered by big, well-known providers often still lag behind inflation. This is why looking for the most competitive rate - not just the biggest name - can help you make your money work harder and protect its purchasing power over time.

Earn almost £400 more interest vs the Big 4 banks with our easy access Cash ISA

Save with a Tembo Cash ISA, and earn 2.7x more interest than if you were to save with one of the Big 4 banks! Plus, unlimited withdrawals, fee-free mortgage advice, and monthly paid interest.

Is inflation an issue in the UK?

While inflation has come down significantly from its peak of over 11% in 2022 - driven largely by soaring energy prices after Russia’s invasion of Ukraine - it had been hovering close to the Bank of England’s 2% target since mid-2024. However, it’s now coming back down again, with current forecasts suggesting it will return to target levels by early 2027.

With inflation coming down, a base rate cut is now looking more likely. The Bank will need to balance cutting rates too soon with supporting the economy - it's likely that if they do cut rates, it might not be by as much as previously expected. This will likely result in mortgage rates and savings rates coming down much more slowly.