11 reasons why you should use Tembo to build your first home deposit

So, you're dreaming of owning your first home and seeking an ally to guide you through reaching one of life’s biggest milestones – building a deposit. Well, you've found your companion. Here's how Tembo can help you pave the way to your first home.

Save with the market-leading Cash Lifetime ISA

Earn 4.52% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

1. Boost your savings with our market-leading LISA interest rate

With a Tembo Cash Lifetime ISA, you’ll earn 4.52% AER (variable) interest on your savings. Already have a LISA? Transferring to Tembo is easy, and over 5-years that simple switch would increase your deposit by hundreds versus the next best available rate. Plus, we’ll have your money transferred in as little as 4 weeks.

2. Join thousands of others using Tembo

Thousands of first-time buyers in the UK are using Tembo to save for their first home already.

Open an account with just £10 or transfer today

Open a Lifetime ISA with Tembo today to benefit from our market-leading 4.52% interest rate, helping you save over £500 more towards your deposit over a 5-year period versus the next best competitor on the market*.

3. It takes just 5 minutes to get set up

Taking the first step towards buying your home couldn’t be easier. Whether you're brand new to the savings game or transferring an existing Lifetime ISA over to us, it only takes a few minutes to get set up.

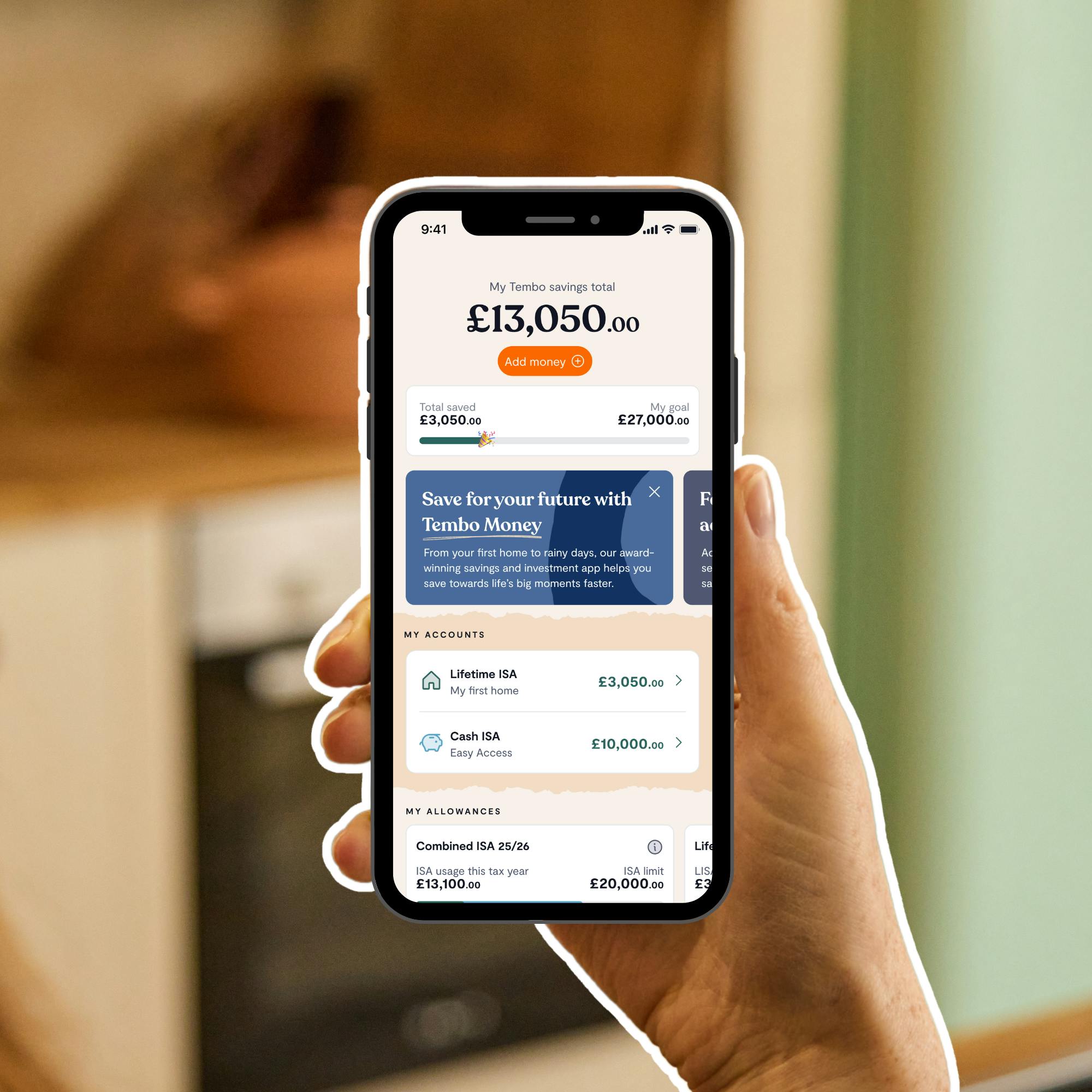

4. One place to manage all things “first home”

Before, the road to buying your first home was fragmented, outdated and just plain confusing. You’d manage your savings account with one app, a budget spreadsheet with another and somewhere along the line, you’d be asked to send something by fax, even though fax machines stopped being a thing like 23 years ago.

So we created the Tembo app - the one-stop shop where you can open an account for your first house deposit, keep track of spending and get heaps of ideas that could help you buy a home sooner. Ah, much better.

5. Set your deposit goal, your way

They say half the work of reaching a goal is having a plan to get there. House deposits are hard milestones to reach - the average deposit in the UK is an eye-watering £53,414, around 19% of the average purchase price. But this varies by where you’re looking to buy, and what type of property you’re after.

In the Tembo app, we’ll help you figure out how much you need for a deposit and other first home expenses like solicitors fees. You can either set your own goal with a budget you have in mind or use our Home Finder feature to base your goal on average house prices in the area you want to buy in (we use real HMRC data to calculate those averages, FYI).

6. Find out how long it could take to buy your first home

We don’t just tell you how much you need to buy your first home, we also show you how long it could take to get there - this is your Time to Buy. Plus, you can discover tips and tricks to cut down your Time to Buy based on your actual spending habits.

When you put money towards your deposit, your Time to Buy goes down - helping you to stay motivated towards buying your first home and picking up those keys 🔑

7. Get up to £1,000 towards your home every year

A Lifetime ISA is a special savings account that comes with a free 25% bonus from the UK government. Every tax year (which runs from April to April), you can put up to £4,000 into your LISA and score an extra £1,000 towards your first home 🔥🔥🔥

Find out all about Lifetime ISAs and the tax year here.

8. Friends and family can help you buy a home with Gift Links

What if we told you there’s an easier way for your friends and family to help you buy a home sooner?

Say goodbye to reciting sort codes over the phone, and say hello to having a personal ✨ Gift Link ✨ that your loved ones can use to add some money to your Tembo Lifetime ISA. That’s your birthday/graduation/wedding gifts sorted! 🎁

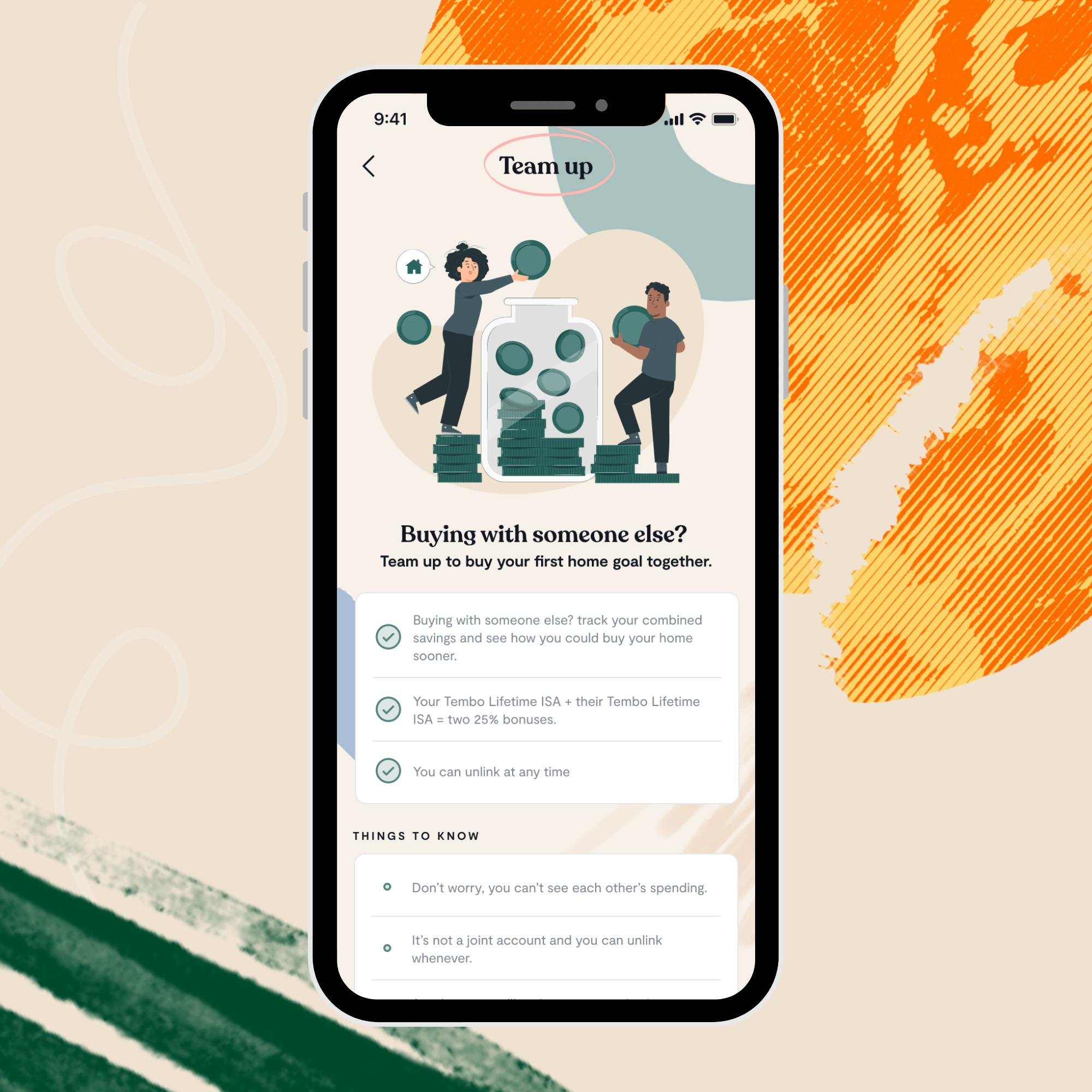

9. The new way to save for a home together

Our ‘Team Up’ feature is like two-player mode for your first home — whether you’re a couple, best friends or family, you can set a joint goal, see how long it’ll take to build your deposit and track your progress together.

No joint bank accounts. No clunky spreadsheets. Just an easy way to work towards buying a place you can both call home.

10. Save for your first home on your own terms

Whether it takes you 1 year or 7 years to build your deposit, life will keep on happening in that time. Jobs change. You might move to a different city. And the “dream home” you pictured a while ago could be completely different from what you want now. So you need a plan that’s ✨ flexible ✨

That’s why we’ve made it easy for you to make xchanges in the app. You can edit your direct debit in seconds. Top up your LISA with one-off contributions. Hey, you can even ‘skip a month’ for those times when money’s tight or you’ve taken “treat yourself” to a whole new level. With Tembo, it couldn’t be easier to get back on track.

11. Learn all about the home-buying process

Think of Tembo as that friend who’s really good with money and knows everything about buying a home.

With our app, you get exclusive content about mortgages, side hustles, property viewings, saving tips and more - all in easy-to-understand, everyday language. No banking jargon here.

“It really helped me get on the property ladder. It’s super clear, helpful, full of great advice and helped me build the financial confidence and motivation I needed.”

Dave

Tembo Lifetime ISA customer

How do I get started with a Tembo Lifetime ISA?

Getting started with Tembo to build your first home deposit is easy. Simply download the Tembo app and sign up to open your Lifetime ISA or transfer your funds from another provider. We’ll walk you through the process step by step, making it easy to set your goals and track your progress along the way. We’ll calculate your time to buy based on how much you save each month and show you ways to build your house deposit sooner.

Are there any specific eligibility criteria I need to use a Tembo Lifetime ISA?

Like with any Lifetime ISA, to open a Tembo LISA you need to be aged between 18-39 and a UK resident. You can only use a Lifetime ISA to buy your first home if you’re a first-time buyer and purchasing a property in the UK for less than £450,000. You also need to buy with a mortgage (i.e. you can’t pay for the property in full upfront) and live in the property once you buy it (no Buy to Let mortgages).

Remember: When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

How does Tembo ensure the security and privacy of my financial information and transactions?

With a Tembo Lifetime ISA, your data and money are safe and secure. Your savings and investments (up to £120,000) are eligible for protection by the Financial Services Compensation Scheme (FSCS). We also use bank-level encryption to keep your money safe. Tembo is also approved by the Financial Conduct Authority (FCA), which means we are regulated and abide by strict governance and compliance rules.

Open a Tembo Lifetime ISA today

Download our award-winning app to start your journey to homeownership in 5 minutes.