What first-time home buyer scheme is right for me?

The average UK house price reached £270,300 in November 2025, meaning first-time buyers would need to save around £27,000 for 10% deposit. In London, where the average home costs £529,400, that figure almost doubles.

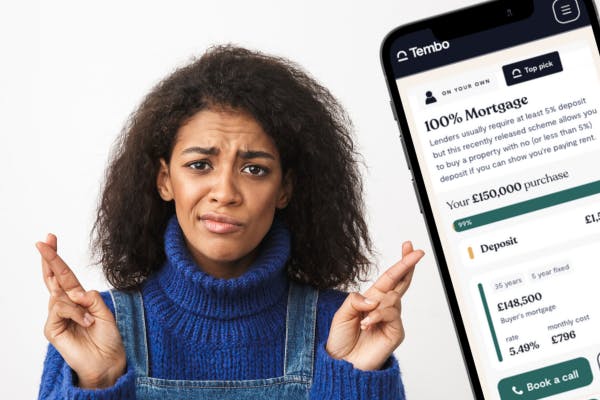

If you’re renting, buying on your own, or struggling to save, getting on the ladder can feel impossible. Thankfully, there are a number of first-time buyer schemes and options designed to help you overcome affordability hurdles and buy a place of your own. But with so many options, it can be hard to know where to start.

Each scheme listed below has specific criteria that applicants need to meet. Schemes targeted at customers with smaller deposits can have higher interest rates than standard products. In order to understand how each scheme meets your specific needs, speak to a broker.

What is a first-time buyer scheme?

A first-time buyer scheme is a scheme or mortgage product designed to help new buyers get on the property ladder. For example, you may find a scheme that lets you buy a home with a small deposit or increase your mortgage size, making it easier to afford a home in your chosen location.

One of the most well-known ones is the government’s First Homes scheme, which allows eligible first-time buyers to purchase a home for 30% to 50% less than its market value. However, there are a few drawbacks to this scheme. For one, there is limited property availability, and you must meet the strict eligibility criteria. When you resell the property, you must also sell it to another eligible first-time buyer at the same percentage discount you bought it at (so 30-50%).

Another well-known first-time buyer scheme is the old Help to Buy equity loan, which is no longer available. This was a government initiative that provided an equity loan equivalent to 20% of the purchase price (40% in London) to first-time buyers, which was interest-free for the first five years. This means that as the buyer, you only had to put down a deposit equivalent to 5% of the purchase price, then get a mortgage to cover the remaining 75%.

However, the Help to Buy equity loan is no longer available, but there are various other first-time buyer schemes now available which you could consider. We’ve covered these below.

You might like: How to get a mortgage 5-6x your salary

Save with the market-leading Cash Lifetime ISA

Save up to £4,000 each tax year and get a free 25% bonus on top of your savings, up to £1,000. Plus, with the Tembo Cash Lifetime ISA, you'll earn 4.52% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

How do first-time buyer schemes work?

It depends, as there’s a wide variety of schemes available. Some reduce the deposit you need, letting you buy with a 5% deposit or in some cases, no deposit at all! Others increase your affordability by letting you add a guarantor to the mortgage or use a family member’s savings as security. If you need help saving a deposit, you might be well-suited to a Lifetime ISA, which boosts your savings by 25%, up to £1,000 per tax year. Find out more about Lifetime ISAs (LISAs) here.

Plus, you may be able to combine more than one scheme. For example, you could use a Lifetime ISA to grow your deposit, and then use a 95% mortgage scheme to reduce the amount you need to pay upfront.

Wondering which first-time buyer scheme is right for you? Let’s take a look at some of the best options in more detail.

Discover what first-time home buyer schemes you’re eligible for

Create a free personalised recommendation on our website in 10 minutes to discover all the ways you could get on the ladder and your maximum buying budget.

Is the first-time buyer scheme ending?

Some schemes (like Help to Buy) have ended, but many still exist – and new ones are being introduced all the time. It can be hard to keep track of what’s available, not to mention what you’re eligible for, as each scheme has its own criteria. A mortgage broker who specialises in these types of schemes - like us - can help you explore all your options. Discover yours today for free by creating a Tembo plan.

Top 10 first-time buyer schemes

1. Lifetime ISA (LISA)

A Lifetime ISA is a special savings account that helps you grow your deposit faster with a free 25% government bonus. You can save up to £4,000 a year, with the government adding up to £1,000 annually.

You can use the money for your first home (worth up to £450,000) or retirement. Keep in mind that if you make a withdrawal before age 60 for anything else, you’ll incur a 25% penalty, which could mean getting back less than you put in.

To open a Lifetime ISA, you must:

- Be aged 18–39 to open one

- Make your first payment before turning 40

- Hold the account open for at least 12 months before using it to buy a home (open is classed as after making your first deposit)

Find the first-time buyer scheme for you

We’ve helped hundreds of first-time buyers discover how they could boost their affordability. Discover what you’re eligible for in 10 minutes by creating a free, personalised mortgage recommendation.

2. Family-supported mortgages (a.k.a guarantor mortgages)

There are several ways your family can help you buy a home, even if they don’t have cash to give you! With a family-supported mortgage, you can use a loved one’s income, savings or property to boost your deposit or borrowing power.

Here are some of the most popular options:

Income Boost

An Income Boost involves adding a relative’s income to your mortgage, without them becoming an owner of the property. With your income and their income combined, you may be eligible for a larger mortgage, helping to bridge the gap between what you can afford on your own and local property prices. Although your guarantor won’t be named on the property, they’ll need to step in and help if you get into difficulties paying your mortgage.

Deposit Boost

A Deposit Boost involves releasing funds from a family member’s property using a small mortgage. They’ll then gift the proceeds to you, and you can use the money as a deposit on your own home. This could help you access lower interest rates or reduce what you need to put down yourself as a deposit.

Savings as Security mortgage

With a Savings as a Security mortgage (aka a springboard mortgage) instead of gifting money, a family member can place their savings into an account with your mortgage lender. The money is held as security, and returned with interest after a set period (typically 5 years) as long as you keep up with repayments.

Each option comes with different responsibilities for you and your loved one, especially if they become liable for your mortgage debt. It’s worth getting advice from a broker to understand the pros and cons before going ahead.

3. 5% deposit schemes

Originally, the government’s Mortgage Guarantee scheme was one of the only ways you could buy a home with just a 5% deposit. Under the scheme, the government guarantees a portion of your mortgage. This gives lenders more confidence to approve high LTV loans, as they’re protected if you fall behind on repayments. The scheme is set to continue under the new Labour government, rebranded as "Freedom to Buy".

However, since it was introduced, some lenders have followed suit, offering their own 5% deposit mortgages, a.k.a 95% loan-to-value (LTV) mortgages. Now, many familiar high-street banks offer 5% deposit mortgages, and can be a great option if you're struggling to save a large deposit and want to get on the ladder sooner.

However, whether you’re eligible for these depends on the lender’s affordability and eligibility criteria. Plus, as you’ll be borrowing more of the property’s value, interest rates may be higher than with lower LTV mortgages. This is because lenders see higher LTV mortgages are more high risk.

Find out more about 5% deposit mortgages here.

On average, our customers boost their budget by £88,000!

We’ve helped hundreds of first-time buyers discover how they could boost their affordability and get on the property ladder. Create a free Tembo plan today for your very own personalised mortgage recommendation.

4. Shared ownership

Shared ownership is a part-buy, part-rent scheme designed to make buying a home more affordable. Instead of purchasing the whole property upfront, you buy a share (typically between 10% and 75%) and pay rent on the remaining share to a housing association or developer.

This means you’ll need a smaller deposit and a smaller mortgage compared to buying the property outright. For example, if you bought a 50% share of a £300,000 home, you’d only need a £15,000 deposit (based on 10%) and a mortgage for the remaining £135,000.

Over time, you can buy more of the property through a process called "staircasing". Eventually, you may be able to own 100% of the property, though it depends on the terms of your lease.

Keep in mind:

- You’ll usually still need to pay service charges and ground rent.

- Not all homes are eligible, and availability varies by area.

- When you sell, the housing provider often has the right of first refusal to buy it back.

Shared ownership can be a good stepping stone onto the property ladder if you’re struggling to buy outright, but it’s important to understand the long-term costs and restrictions before going ahead.

5. Deposit Unlock

Deposit Unlock lets first-time buyers buy a new build home with just a 5% deposit. Normally, lenders require larger deposits for new builds - often 15% or more. With Deposit Unlock, selected house builders and lenders work together to reduce the risk for mortgage providers by insuring the mortgage. This gives buyers access to 95% loan-to-value mortgages, making new builds more affordable.

To use Deposit Unlock, you’ll need to:

- Buy a home from a participating developer

- Choose a mortgage from one of the scheme’s approved lenders

- Stay within the property price cap of £750,000

Keep in mind:

- Only a limited number of builders and lenders are part of the scheme

- You might not get access to the best mortgage rates on the market

- It’s only available on selected new-build homes

If you’ve got a small deposit and want to buy a new build, Deposit Unlock could be a great option. Just make sure you explore all your choices, as there may be other schemes that suit your needs better.

Take a look at our new build vs old house guide to learn more.

6. Enhanced borrowing schemes

Certain buyers (e.g. professionals, key workers or high earners) could borrow 5–6x their income instead of the standard 4–4.5x. This could help you bridge the gap between what you can afford on a standard mortgage, and local house prices in your area. Whether you’re eligible depends on your profession and your income, and other factors.

Find out more about these higher lending schemes here.

7. Rent to Buy (England, Wales, NI) & London Living Rent

Rent to Buy lets you rent a home at a discounted rate while you save for a deposit. It’s designed to help first-time buyers gradually transition from renting to homeownership. The discount is usually around 20% below market rent, which can free up more of your income to put towards savings.

Here’s how it works across the UK:

- England (excluding London): Rent a new build home at a reduced rate for 6 months to 5 years. During this time, you’ll have the option to buy the home or a share of it using shared ownership.

- London Living Rent: Aimed at middle-income Londoners, this scheme offers discounted rents (typically two-thirds of market rent) to help you save for a deposit. Average rent for a 2-bed is around £1,240/month—much less than market rent.

- Wales – Rent to Own: Rent your home for up to 5 years. After 2 years, you’ll have the option to buy. If you choose to go ahead, 25% of the rent you’ve paid and 50% of any increase in property value is returned to you to use as a deposit.

- Northern Ireland – Rent to Own: A non-profit called Co-Ownership buys the home and rents it to you for up to 3 years. If you decide to buy after 1 year, your initial down payment and part of your rent is refunded to go towards the purchase.

Keep in mind:

- Not all landlords or housing providers offer this scheme

- You’ll still need to qualify for a mortgage when the time comes to buy

- It’s not guaranteed that you’ll be able to purchase the property at the end of the tenancy

Rent to Buy can be a great option if you need time to build up savings but want to plan ahead for homeownership.

10. Right to Buy

The Right to Buy scheme gives eligible council and housing association tenants in England the chance to buy their home at a discounted price. The longer you’ve lived in the property, the bigger the discount you could receive - up to £102,400, or £136,400 if you live in London (2025/26 tax year).

You can use a mortgage to fund the purchase, and in some cases, combine it with other schemes or a gifted deposit.

To be eligible, you must:

- Have rented from the public sector for at least 3 years (not necessarily in a row)

- Be a secure tenant of a council or housing association

- Use the property as your main home

Keep in mind:

- Not all properties or tenants qualify, especially if your home is managed by a housing association without an agreement in place

- If you sell the property within 5 years, you may need to repay some or all of the discount

- You’ll be responsible for all maintenance and repairs once you become the homeowner

Right to Buy can be a great way to get on the ladder if you already rent a council property and want to turn it into a long-term home.

If you’re a council tenant, you may be able to buy your home at a significant discount – up to £102,400 (£136,400 in London). The longer you’ve lived there, the bigger the discount.

What other perks and relief can first-time buyers get?

Here are just a few first-time buyer incentives and perks you can expect:

- Stamp Duty relief: Pay no Stamp Duty on homes up to £300,000 in England or NI. Scotland and Wales have their own thresholds. See what you’ll pay here

- ISA bonuses: Lifetime ISAs give a 25% boost from the government.

- Developer offers: Some home builders offer deposit schemes, cashback, legal fee discounts or upgrades on fixtures and fittings.

Learn more

*Based on saving £1,000 at the beginning of each year for 5-years. Calculations show that after 5-years (in the 61st month) Tembo customers saving at 4.10% would have £584.01 on average more than saving with the next best competitor on the market.