What is the lowest LTV on a mortgage?

How does LTV work, how does it affect your ability to buy a house and what’s the lowest LTV on a mortgage you can get? This guide covers everything homebuyers need to know about LTVs.

Key Takeaways

- LTV (Loan to Value) is the percentage of a property's value that you borrow as a mortgage.

- While technically any amount under 1% is possible for those nearly finished paying, 60% LTV is typically the lowest standard product offered by lenders.

- As a general rule, the lower your LTV, the lower your interest rate, as you represent less risk to the lender.

- Most lenders require at least a 5% to 10% deposit (95% or 90% LTV).

- You can lower your LTV by saving a larger deposit or purchasing a less expensive property.

Get moving with the UK’s Best Mortgage Broker

Our award-winning team of mortgage brokers have helped thousands discover how they could make home happen. Start your journey today.

What is Loan to Value (LTV)?

LTV stands for Loan to Value. It’s a percentage that represents the size of your mortgage compared to the value of the property. For example, if a buyer purchases a house worth £300,000 with a £60,000 deposit and a £240,000 mortgage, the deposit is 20% of the property's price, which means the LTV is 80%.

How does the LTV ratio work?

LTV helps you understand how lenders assess risk when considering your mortgage application. It plays a key part in lenders’ mortgage affordability checks when they look at your income, credit rating and expenses to make sure the loan is affordable. A higher LTV means you’re borrowing a larger percentage of the property’s value for a mortgage. This is riskier for lenders, so you’ll usually be offered a higher interest rate.

A low LTV means you’ve saved a larger deposit or have built up a large amount of equity in your home over time. As low LTV mortgages are less risky, lenders often reward these borrowers with more competitive interest rates.

How to calculate the LTV ratio

To calculate an LTV, divide the mortgage amount by the property's value and multiply by 100.

To calculate your LTV, use the following formula:

- Formula: (Mortgage Amount ÷ Property Value) x 100 = LTV %

- Example: (£450,000 ÷ £500,000) x 100 = 90% LTV

Is there a minimum LTV ratio?

There's no minimum LTV rule that all lenders must follow. If a borrower is eligible for a 100% mortgage, it’s possible to buy a house with no deposit. However, individual lenders will set their own criteria and will usually have guidelines outlining the minimum and maximum LTV they’re willing to offer.

Most lenders prefer borrowers to have a deposit of at least 10%, meaning the maximum LTV is usually 90%. If a borrower is struggling to save a 10% deposit, it may be possible to get a 95% LTV mortgage (5% deposit). To qualify, borrowers will usually need an excellent credit history, a good income, and sometimes a guarantor.

The lower the Loan to Value, the better interest rates borrowers will usually have access to. This can make your monthly payments more affordable and reduce the amount you spend on your mortgage overall, as well as reduce the size of your debt.

Learn more: How to buy a house with a small deposit

What is the lowest LTV offered on a mortgage?

For practical purposes, 60% LTV is typically the lowest LTV band offered by lenders for new mortgages and remortgages, though some lenders offer 50% or 40% LTV products.

Most lenders also have a minimum amount they’re willing to lend. For example, Nationwide’s minimum mortgage size is £25,000, while Barclays’ minimum loan size on residential mortgages is much lower at £5,000. A few years ago,, Halifax’s minimum mortgage amount for 2 to 5-year products increased from £25,000 to £100,000 through selected brokers.

Who qualifies for a low LTV ratio?

You may be eligible for a mortgage with a low LTV ratio if you have a deposit equivalent to 20% of the property price or more, as mortgages with an LTV of 80% are usually considered low. However, a big deposit doesn't guarantee a borrower a mortgage. You’ll still need to meet the lender's affordability criteria. Income, credit score and even current living expenses will also be considered.

On average, our customers boost their budgets by £88,000

Whether you want to get on the ladder or move up it, you’re in the right place. Tembo can help you discover ways to increase your buying power or help you overcome affordability hurdles to make home happen.

How to reduce an LTV ratio

To reduce your LTV ratio, you can either save a larger deposit or choose a cheaper property. Here is how different scenarios affect your LTV:

- Scenario 1: £10,000 deposit on a £200,000 house = 95% LTV

- Scenario 2: £20,000 deposit on a £200,000 house = 90% LTV

- Scenario 3: £20,000 deposit on a £100,000 house = 80% LTV

LTV is grouped into brackets - normally 95%, 90%, 80%, 75% etc. If a borrower's LTV falls between two brackets, they will likely be offered rates at the higher LTV. So if the actual LTV is 93%, you’ll be offered rates from the 95% LTV bracket, not the 90% bracket.

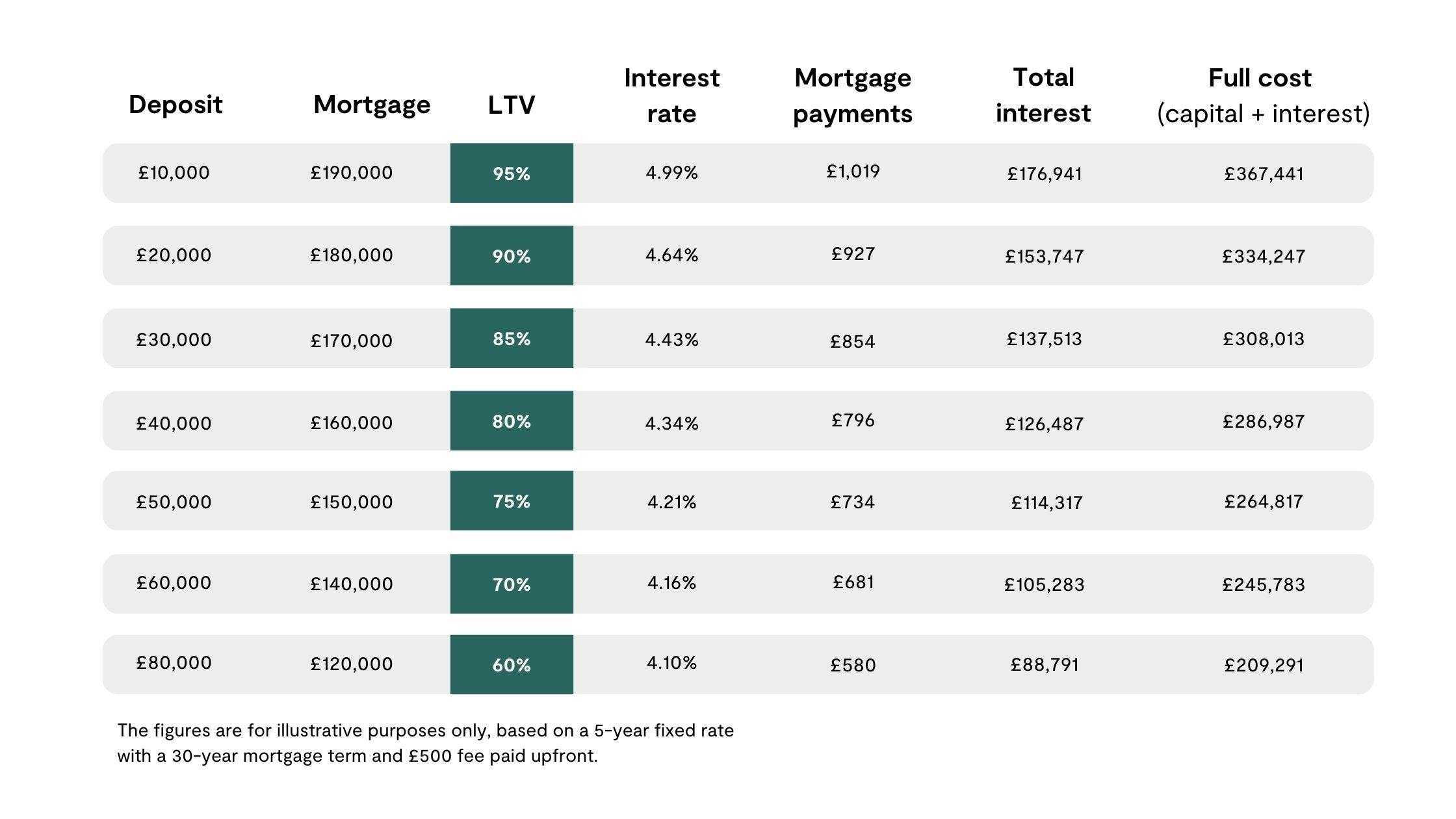

The table below shows how a lower LTV can impact what interest rate you’ll be offered, and therefore your mortgage payments, the amount of interest payable and the full cost of you mortgage.

Save faster with the Tembo Cash Lifetime ISA

Save up to £4,000 each tax year and get a free 25% bonus on top of your savings, up to £1,000. Plus, with the Tembo Cash Lifetime ISA, you'll earn 4.52% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.