Bank of England cuts base rate for first-time since 2020

It’s big news for mortgages as the Bank of England has voted to cut the base rate after 4-years of rises or holds.

Today's announcement was hotly debated, unlike previous meetings, where a hold was more or less a given.

In the run up to today's vote, economists were torn on whether the BoE would cut, or hang on until the next meeting on September 19th. Market predictions showed a 55% chance that the Bank would cut, and a 45% chance that it would leave it on hold. But, there has been mounting pressure on the Bank to cut its rate.

In the end, it was a knife-edge decision, with the MPC voting 5-4 for a reduction.

Why has the Bank decided to cut the base rate now?

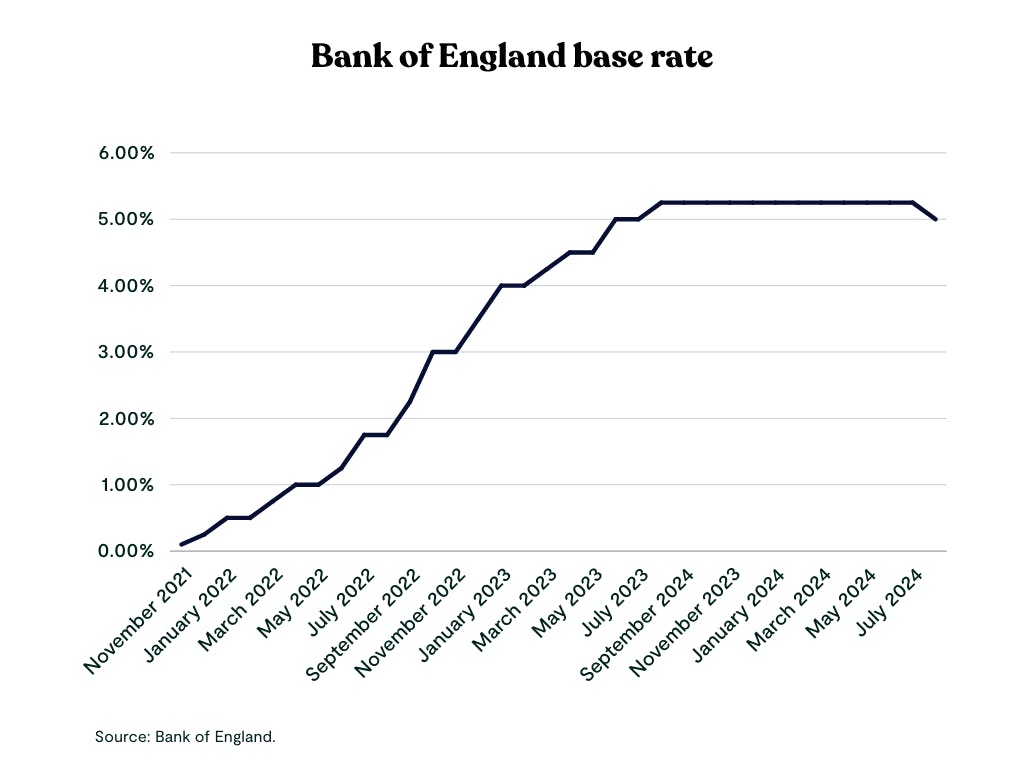

The Bank has been holding off to prevent sending shockwaves through the market. By making borrowing more expensive, the Bank hopes we all stop spending as much to reduce demand. This helps to bring inflation down, as businesses can't increase their prices as quickly.

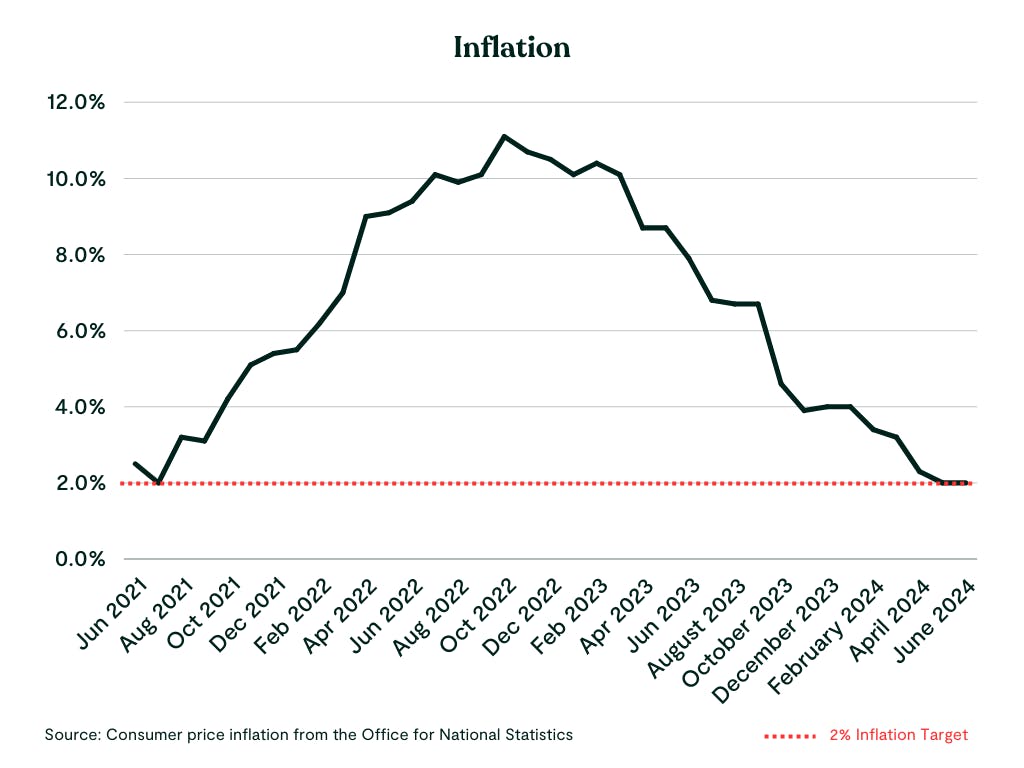

So far, this tactic has worked - inflation is down from a 41-year high of 11.1% back in October 2022 to 2.0% in May. But, by keeping rates high for too long, the Bank risks suppressing economic growth. This is why there have been more and more calls for the Bank to cut the base rate, with accusations that it has been slow off the mark.

Ready to make home happen?

We’ve already helped thousands of home buyers and remortgagers discover how they could boost their mortgage affordability. So they can buy sooner, or stay in the home they love.

What's going to happen to interest rates?

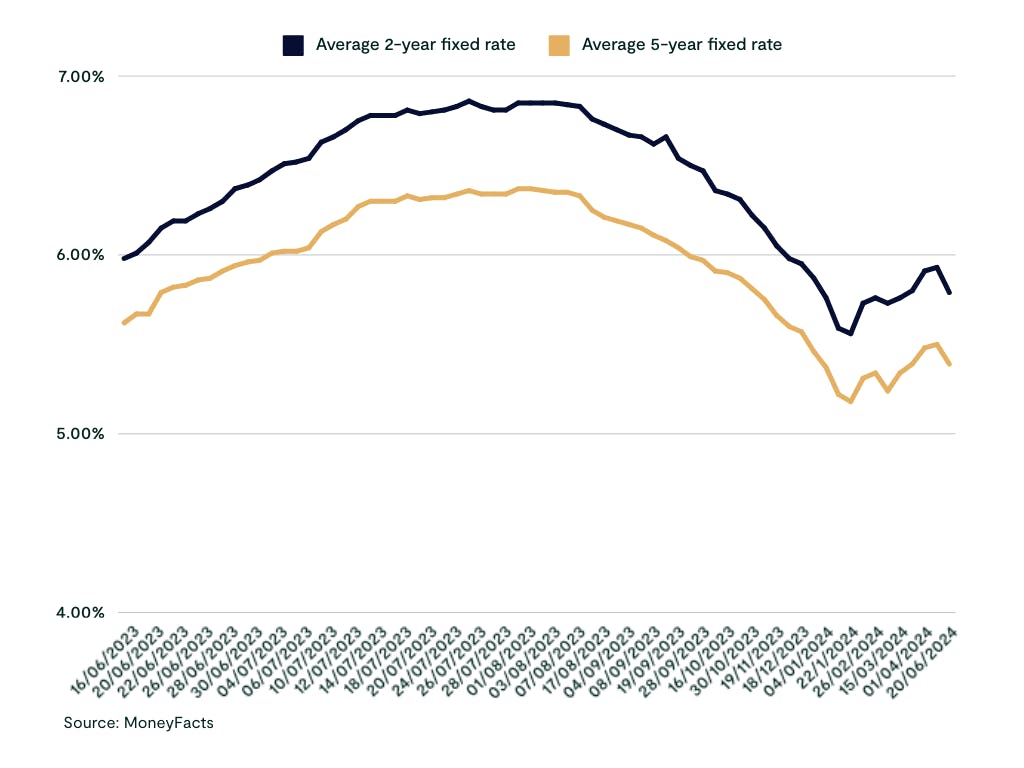

Major mortgage lenders have already priced in a base rate reduction into their fixed-rate deals, with one big name announcing a five-year fix rate for 3.99%. But swap rates – the main influence on fixed rate deals – have been falling slowly over the past month, which gives lenders wiggle room to pass savings on to borrowers. Just this morning, three big high street lenders dropped their rates, and we'd expect to see others follow suit.

For those already on variable and tracker rate deals, you'll see an immediate drop in monthly repayments. In fact, if you're on a tracker rate, today's 0.25% cut could take your monthly repayments down by around £28 a month on average!

On the flip side, savers have been benefitting from high interest rates up till now - so you could see the rates on your savings account drop after today’s decision. So make sure you’ve got your money in an account with a competitive interest rate!

What’s going to happen to house prices?

The base rate is a key driver for the mortgage market, as it impacts customer confidence. We know that many of our customers have been holding off for a base rate drop. Whilst not a huge amount will change rate-wise today, this will nonetheless act as a "green-light" for many.

More market activity could also lead to house price growth. If you look back at past base rate cut cycles, house prices increased by 8% on average in the year following the first rate cut - although house prices are only expected to be 2% higher over 2024.

Could now be your time? Well there's currently less buyer competition to contend with, and getting on the ladder now will mean you can benefit from any potential house price growth next year. As always, seek professional advice before making any big decisions. And if you need us, you know where we are.

When is the next base rate review?

The Bank of England's MPC will next meet to review the base rate again on Thursday 19th September 2024. They will decide whether to hold the base rate at its new level of 5.0%, or cut it again.

See what mortgage rate you could get

By creating a Tembo mortgage recommendation, we compare your eligibility to thousands of mortgage products and over 100 lenders. So you can see all the ways you could get on the ladder, move up it or remortgage. It’s completely free, and there’s no credit check.