Is now a good time to buy a house?

Deciding whether to buy a house is one of the biggest financial choices you'll make. It’s not just about finding the right property; it’s about timing, affordability, and your personal circumstances.

In this guide, we walk through what’s predicted for the UK housing market in 2026 and key factors to help you decide if next year is the right time for you to step onto or move up the property ladder.

Buying a home? Earn 5.75% AER (variable) on your savings while you save

Mortgages can feel like a maze of paperwork and decisions. With HomeSaver, there'll be a reward waiting for you at the finish line, whether you're buying your first place, your next, or remortgaging.

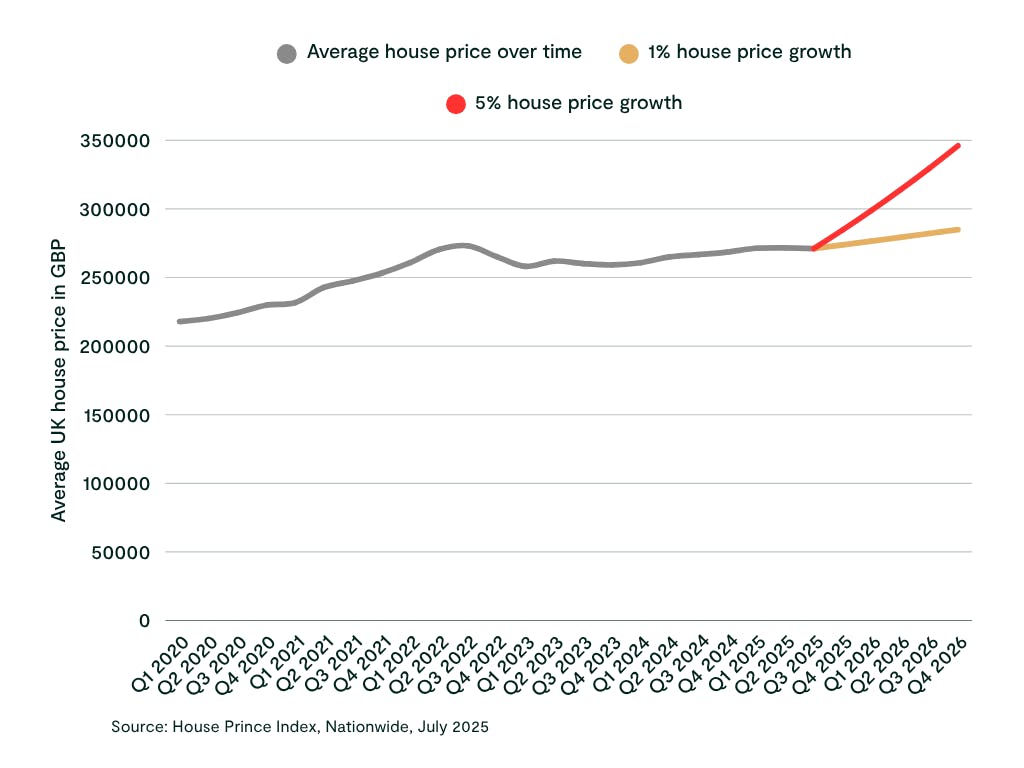

What will happen to house prices in 2026?

Most property pros are betting on the housing market cooling off a bit in 2026. No cliff-edge price drops - just a gentle, steady rise in house prices, likely between 1% and 5%. It’s a far cry from those whirlwind years of rapid growth. But this could give buyers a little more time and space to weigh up their options.

Here’s why this could work in your favour:

- More homes on the market: With more sellers (think landlords or folks with second homes) possibly deciding to sell, you could see more choice out there. With more supply, it could maybe even a bit of wiggle room on price. Read our tips on how to negotiate on house price.

- Regional differences: Not every area plays by the same rules. If you’re hunting for value, the North West, Midlands, or parts of Scotland are places to watch. Busy cities like Manchester and Liverpool are still in demand. If you’ve got your sights set on London or the South East, expect higher prices.

- The economic backdrop: If inflation stays in check and wages creep up, buyers tend to feel more confident - which could help steady the market and keep those wild price swings at bay.

What will mortgage rates do in 2026?

Right now, predictions for 2026 say mortgage rates could get easier on borrowers. But by how much depends on who you ask. It all hinges on moves from the Bank of England and what happens with inflation.

After a few reductions in 2024 and 2025, it’s expected that the Bank of England's base rate - which impacts the rates offered by lenders on mortgages - won't be cut again until early 2026. If that pans out, if mortgage rates do drop in 2026, it's likely to be a gradual decline. It could be the middle of 2026 before the market feels the full effect.

If this pans out, here’s what you can expect:

- Smaller monthly payments: Lower mortgage rates equal less pressure on your budget, and possibly a bit more borrowing power if you need it.

- Hotter deals from lenders: When rate cuts are expected, mortgage lenders love to reduce their fixed rate deals before the cut is announced.

- Think ahead: You can often lock in a mortgage offer up to six months in advance, giving you a buffer if rates swing back up unexpectedly.

Top Tip

Many lenders factor future rate cuts into their mortgage products when they ‘price’ (set an interest rate on a fixed-term mortgage), so changes to the base rate won’t necessarily result in mortgage interest rates decreasing too.

See what rate you could be offered without applying

When you create a free Tembo plan, our smart tech will compare your eligibility to thousands of mortgage products to find all the ways you could buy sooner or remortgage.

When is the best time to buy a house?

Historically, spring and autumn are the busiest periods in the year for buying a house, as there are more houses available, and people are eager to get the ball rolling if they've decided this is the year to get on the ladder. Summer and winter tend to be quieter, so these can be good times to buy a house when there is a dip in house-hunting. When there is less demand, you could find you're able to bag a bargain.

However, during uncertain economic times, buying a house can feel riskier, regardless of the time of year. Soaring inflation and higher mortgage interest rates may make you think that right now is a bad time to buy a house. However, if you can afford to get a mortgage now, don't let scary headlines put you off.

Is 2026 the right year for you to buy?

While the market is important, the biggest factor when deciding whether to buy a home in 2026 is you. Are your finances ship-shape? Does buying right now line up with your plans? Before you spend hours scrolling Rightmove “just in case,” get your basics covered:

- Grow your deposit: Aim for a down payment of at least 10-20%. The bigger your deposit, the better your chance of nabbing a great mortgage rate.

- Spruce up your credit score: This matters more than you think! Pay off old debts, shut down cards you don’t use, and keep up with all your payments (plus, make sure you’re on the electoral roll).

- Plan for the full cost of owning: Your monthly loan isn’t the only outlay - remember stamp duty, legal fees, as well as ongoing costs like council tax, insurance, and the odd surprise plumber bill.

Should I buy a house now or wait until 2027?

Ultimately, the decision to buy a house now or wait until 2027 hinges on your personal financial situation and readiness. While market conditions fluctuate, the most significant factor is your ability to comfortably afford a mortgage and all associated homeownership costs.

If your finances are in order – with a solid deposit, good credit score, and a clear understanding of ongoing expenses – then buying sooner might be a viable option. If you need more time to save, improve your credit, or plan for future costs, waiting could be the smarter move.

If you think you can't buy right now, you might be surprised! At Tembo, we specialise in helping buyers discover their true buying budget. In fact, on average we boost our customers' budgets by £88,000! It's easy to discover all the ways you could get on the ladder, just create a free Tembo plan in minutes!

Discover all the ways you could boost your budget

With a Tembo plan, you'll get a personalised recommendation on what specialist buying schemes you're eligible for. Find out how much you could boost your buying budget through one of these schemes by creating a free plan today.