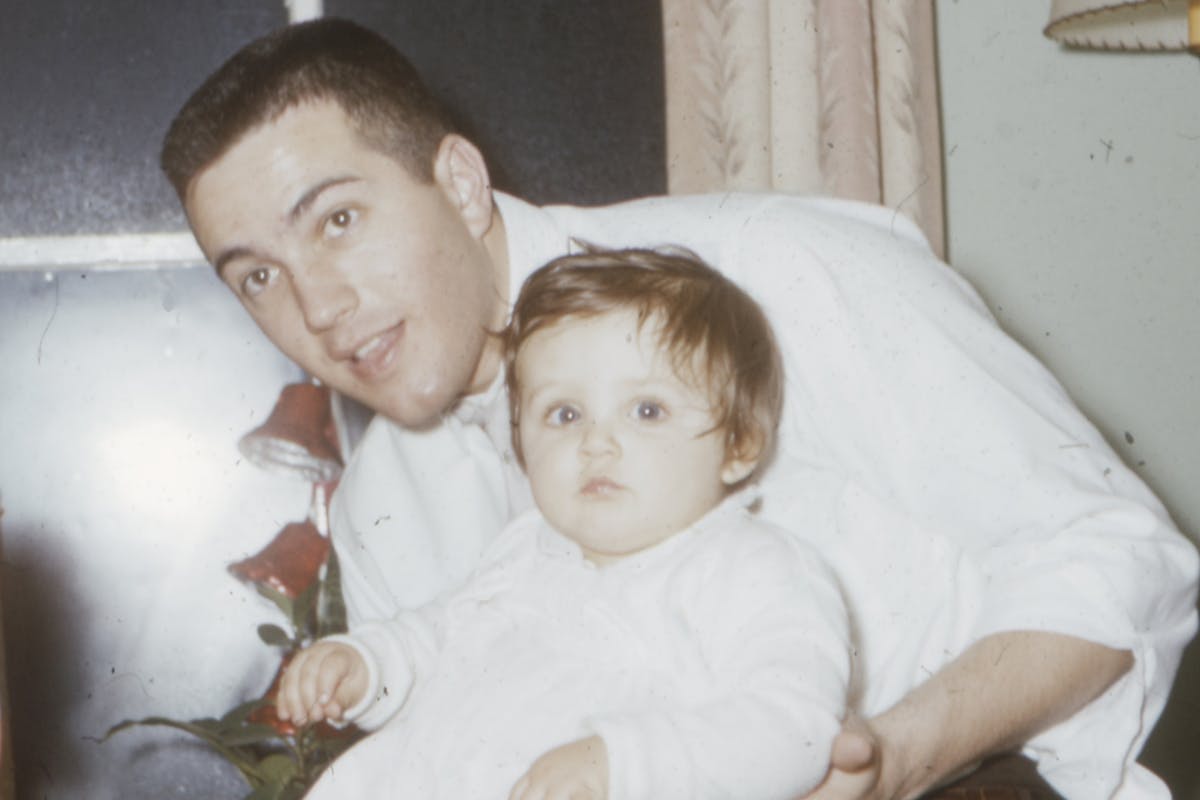

Help your child buy a home of their own

Looking to help your child or loved one get a mortgage? We’re an award-winning mortgage broker on a mission to make home happen for a new generation. We help families support their children with buying a home, using a range of guarantor mortgages and budget boosting schemes.

Average £88,000 boost to affordability

Voted the UK's Best Mortgage Broker

Same day appointments, 7-days a week

How can I help my child get on the property ladder?

Buying a home has never been harder. As house prices have skyrocketed, a new generation of homeowners have found themselves priced out of the property market. This means young adults are more reliant than ever family support, but not every family has cash to give. Tembo specialises in alternative ways to support first time buyers in purchasing their home, even without cash gifts from loved ones.

Why Tembo?

We help buyers, movers and homeowners discover how they could boost their affordability in 3 simple steps. It’s why we’re the UK’s Best Mortgage Broker.

Family supported mortgages

Income Boost

If your child has saved up some deposit but their maximum borrowing is too low to get a suitable mortgage, an Income Boost could be for you. Also known as a Joint Borrower Sole Proprietor mortgage, an Income Boost enable you to add your income to the buyer's mortgage to increase their affordability.

Deposit Boost

If your loved one is struggling to save a large enough deposit and you own a home, a Deposit Boost could be the answer. By unlocking money from your property in an affordable & ethical way, you could get them on the ladder faster and help them make big savings in interest.

Savings as Security

If you do have cash savings, but feel uncertain about gifting your child money, a Savings as Security mortgage could be the solution. By depositing 10% of a property's value into an account held by the lender, your loved one can get a mortgage with no deposit saved up. After the end of a set term, you'll get your savings back, plus interest.

Deposit Loan

Saving up a deposit can often be the biggest barrier to homeownership. By contributing to your child's house deposit, they can get on the ladder sooner as well as access better mortgage rates. In return, you'll own a percentage of their home.

The application process

4 simple steps to your loved one getting the keys to their new home

Make a Tembo plan

Check your family’s eligibility for our family mortgages and get a personalised recommendation with interest rates and repayments in under 10-minutes.

Talk to an expert

Book a call with our experts to complete the qualification process, and we’ll cover off any questions you might have about family mortgages and any other schemes.

Find a property

Once your child has found a property, your dedicated advisor will undertake full affordability checks to prepare the mortgage application. Then we’ll submit it on their behalf!

Make home happen

During conveyancing, we’ll liaise with the seller and your solicitors to ensure a smooth purchase. We’ll also provide a free protection review for your child’s insurance needs.

Tried, tested, trusted.

We've helped thousands of families discover how they could help their loved ones buy sooner with a guarantor mortgage. Read 5* rated reviews from some of our happy customers, or create a free Tembo plan to see how a guarantor mortgage could them buy sooner.

Got questions? We've got answers

See all FAQsFrequently asked questions

Learn more

We've hand picked our top guides to answer your mortgage questions. You can explore all of our guides in our Mortgage Guides Hub.