How much do I need in a pension?

Sabbah Ali

Sabbah AliWorking out how much you need in your pension can feel like an overwhelming task. How much will you need each year to live off? What should you be contributing now to build up a big enough pot? In this article, we’ll tell you everything you need to know about how much you should have in your retirement pot.

In this guide

Please note that Tembo is not a pension provider. If you want advice on your pension, we recommend speaking to a qualified pension advisor.

How much pension do I need?

To work out how much pension you need, first work backwards by working out how much you want your “retirement income” to be. This is essentially how much money you want to live off each year once you’re retired. People tend to spend less as they get older, even when you take inflation into account. Plus, you won’t have commuting costs or potentially spend as much on travel, clothes or bucket-list items. As a rule of thumb, aim for an annual retirement income of between 50-70% of your working income. Or check out the recommended retirement income by Nuts About Money. Once you’ve worked out what you need your retirement income to be, you can work out how much you’ll need overall in your pension pot.

The average income in the UK is £35,000. Based on this, an average retirement income would be between £17,500 and £24,500. Let’s say you want to retire at 70, and need to fund retirement for 30 years. That would mean saving £525,000 - £735,000 into a pension pot to fund your retirement.

Sounds like a lot, huh? And what about if your salary goes up over time, which it likely will. Don’t worry, we’ll break down how you could get there. First off, let’s run through the types of pensions you can have.

What are the types of pensions?

There are three main types of pension accounts:

- State Pension

- Workplace pension

- Private pension

How does the State Pension work?

The State Pension is provided by the government to everyone who has built up enough qualifying years of National Insurance credits - which you get by working and paying tax. You can start claiming your State Pension once you reach the State Pension Age. Your State Pension Age depends on when you were born. For those born before 5th April 1960, the State Pension Age is 66 for both women and men. For those born after this, the State Pension Age goes up over time.

Did you know? You can use the government’s State Pension Age Calculator to work out yours

How does a workplace pension work?

A workplace pension is a pension scheme that helps you save for your retirement by making contributions deducted directly from your earnings. Your employer will also make contributions to your pension pot - typically 3% of your salary. Normally, when you join a company that has a workplace pension, you will be auto-enrolled into the scheme, and will likely be signed up to pay a percentage of your salary into your pension each month.

Although you can increase the amount you pay, and normally opt out of the scheme if you want to save your money for a private pension or say a Lifetime ISA for retirement instead. But it’s a good idea to pay into a workplace pension if you can, as you’ll benefit from your employer also contributing. By not contributing to a pension scheme, you may lose the benefit of contributions by an employer (if any) to that scheme. Plus, you’ll tax relief on the contributions you make to the scheme.

If you’re self-employed, it’s a good idea to start your own personal pension pot. A Lifetime ISA can be a great way to save up for retirement if you work for yourself. You can save up to £4,000 each year, and the government will give you a free 25% bonus on your savings. You have to open one before you’re aged 40, but can keep adding to it all the way until you’re 50. You can then use your savings to fund retirement once you’re 60 years old. Be aware that saving in a LISA may affect your entitlement to means-tested benefits.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

Will I get the State Pension and workplace pension?

Yes, you can get both the State Pension and a workplace pension. How much you get from your State Pension depends on how many qualifying years you’ve accumulated National Insurance credits through working and paying taxes. To get the full State Pension, you’ll need 35 qualifying years, but as long as you have between 10-35 years you’ll receive a portion of the State Pension. How much you get from your workplace pension depends on how much you and your employer have paid into your workplace pension, as well as where your pension funds are invested and their performance over time.

Top tip

You can keep working past your State Pension Age and still receive your State Pension.

How much should I contribute to my pension?

A good rule to follow is to aim to contribute half your age as a percentage to your pension. So if you’re 30 years old, aim for putting 15% of your salary into your pension; if you’re 40 years old, aim for 20% and so on. But if you can’t manage this amount, just aim for as much as you can.

For example, let’s say you’re 30 years old, and earn the average UK salary of £35,000, and every 5 years you get a 5% increase in your salary. By the time you’re 70 and want to retire, you want a retirement income of £25,855 (50% of your working income). By that time, you’ve qualified to receive the full State Pension, which currently works out as an annual income of £11,502. That leaves you with just under £14,353 to cover through your other pension sources.

For argument’s sake, let’s imagine you have £5,000 in your workplace pension pot already and contribute 8% of your salary each month (5% from you, 3% from your employer).

By the time you’re 70, you’d have £142,824 in your pension pot - excluding any growth from investment growth - which would give you a retirement income of £4,761. Together with your State Pension, you’d have an overall pension income of £16,263.

Now let’s factor in annual investment growth

If your pension sees a low annual growth rate of 2%, you’d end up with £220,504, giving you an overall retirement income of £18,852 (including the full State Pension) - £7,00 shy of your retirement income goal. If your pension pot sees a high annual growth rate of say 8%, you’d end up with £1,056,289, giving you a retirement income of £46,712 - almost double your goal! A medium growth rate of 5% would give you a pension pot of £462,468, or £26,918 - just over your target.

So you can see how over time it is possible to build up a pension pot to fund your retirement, especially when you take potential investment growth into account. And that’s all without putting any more money away or increasing your contribution over time!

Remember that there is no guarantee that your pension investments will go up over time - past performance is not a guide to future returns.

Start saving for later on in life

Open a Cash ISA with us today. You can save up to £20,000, tax-free, every single tax year for future you. Plus, benefit from our unlimited withdrawals, a competitive interest rate of 3.8% AER (variable) paid into your account monthly, and fee-free mortgage advice.

How much can I pay into my pension?

You can pay into your pension as much as you’d like, but there is a cap on how much tax relief you can get on your contributions. You have an ‘annual allowance’ for the maximum you can contribute to your pension without paying tax. For most people, the annual allowance will be equivalent to 100% of your salary or £60,000 – whichever is lower.

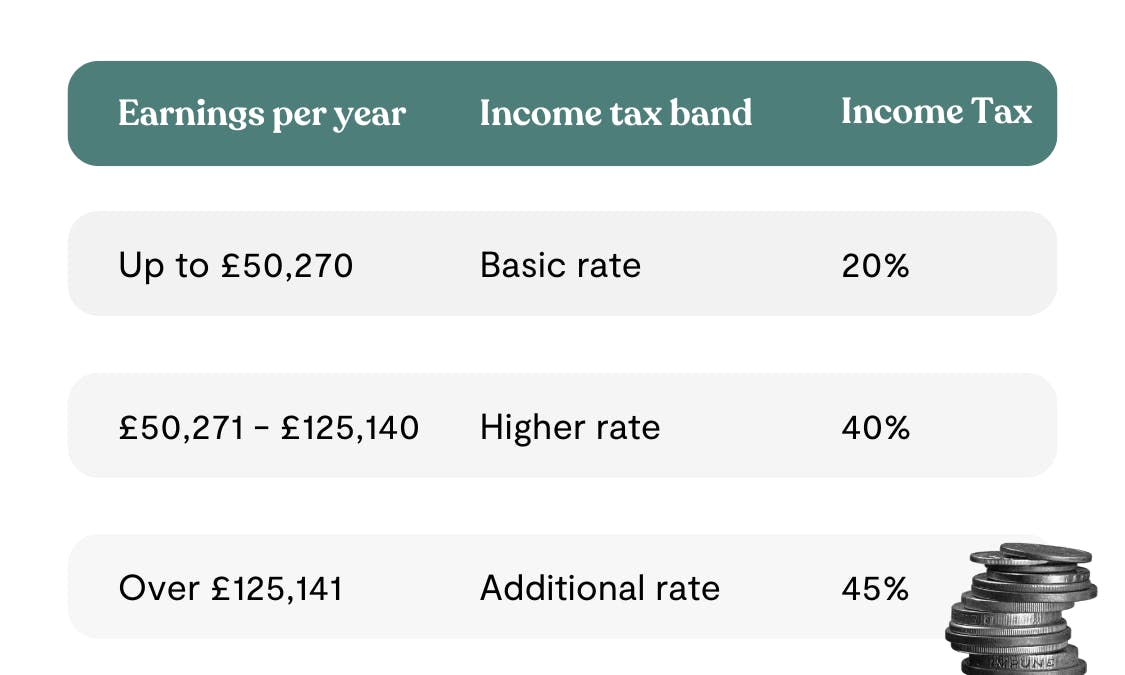

If you exceed this limit in a tax year across all your pension pots, the amount you’ve exceeded the annual allowance by will be added to the rest of your taxable income for the tax year and be subject to Income Tax.

Your pension provider might cover the charge

You might be able to ask your pension scheme to pay the annual allowance charge from your pension. This is known as Scheme Pays, but note that it means your pension would be reduced. Check with your provider if you are able to do this or not.

Is it worth putting a lump sum into a pension?

It can sometimes be worth putting in a lump sum into your pension, especially if you haven’t used up your pension annual allowance before the end of the tax year. Putting in a lump sum into your pension will also give it more time to grow and potentially give you more money when you retire. If you have a workplace pension where your employer matches your contributions, putting in a lump sum will also mean extra money from them for your pension pot.

However, topping up your pension with one-off contributions shouldn’t replace regularly paying into your pension. Adding to your retirement fund over time can help it grow, especially if the account sees decent investment growth each year.

Build your pension pot with our market-leading Cash Lifetime ISA

Save up to £4,000 per tax year in our Cash Lifetime ISA with our market-leading 4.52% AER interest rate (variable). Plus, get a 25% government bonus of up to £1,000 per tax year to boost your retirement pot.

By saving into a Lifetime ISA instead of enrolling in or contributing to a pension, you may lose out on contributions by an employer (if any), and it may affect your entitlement to means-tested benefits. Withdrawals from a Lifetime ISA for any purpose other than buying a first home (up to a value of £450,000) or for retirement (60+) incur a 25% government penalty, meaning you may get back less than you paid in.”